As utilization goes, so goes The Scooter Store

By Elizabeth Deprey

Updated Fri October 5, 2012

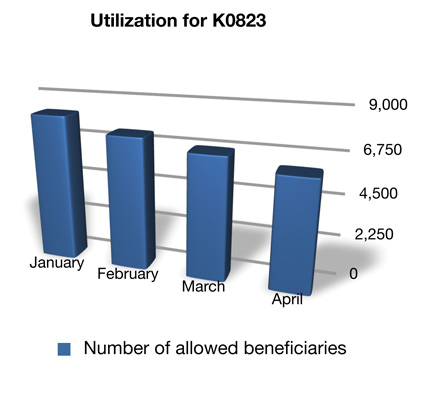

NEW BRAUNFELS, Texas - Utilization for K0823, the most popular power wheelchair, is down about 25% so far this year—a statistic not lost on The Scooter Store.

The top provider of power wheelchairs announced in September that it plans to lay off 220 employees. The company blamed changes in Medicare policy, which have been a big factor in driving down utilization, for the layoffs.

"Utilization is definitely down for K0823," says Martin Szmal, owner of The Mobility Consultants.

In the first four months of 2012, the number of allowed Medicare beneficiaries for K0823 decreased from 8,097 in January to 6,069 in April, about a 25% drop, according to data acquired by HME News through a Freedom of Information Act request.

One of the biggest changes in Medicare policy to drive down utilization, stakeholders say: the dramatic increase in audits. The stakes are so high that even some physicians are abandoning the benefit, they say.

“In the last year or two, doctor's offices have told us: We do not fill out Medicare paperwork anymore,” said Rick Perrotta, president of Network Medical Supply.

Audits have helped to not only reduce utilization but also tie up staff resources and freeze up cash flow, stakeholders say.

"Providers are spending a lot of money to get less reimbursement," Szmal said. "The return on investment just isn't what it used to be."

Unfortunately, the struggles at The Scooter Store are representative of what's going on in the power mobility industry at large, just on a much larger and much more public scale, stakeholders say.

“Our volume is down, too,” Perrotta said.

Other changes to Medicare policy that have helped to drive down utilization: documentation changes (2006), competitive bidding (2011), elimination of the first-month purchase option (2011) and, most recently, for providers in seven states, a PMD demo (2012).

"It's been a perfect storm," said John Letizia, chairman of AAHomecare's Complex Rehab and Mobility Council. "If you look at the mobility market and all the changes we've been through—it's such a different market than it was five or six years ago."

Comments